does instacart take out taxes for employees

Getting started on Instacart is a simple process. What documentation do I need to file my taxes.

When Does Instacart Pay Me A Contracted Employee S Guide

Choose a session in the app.

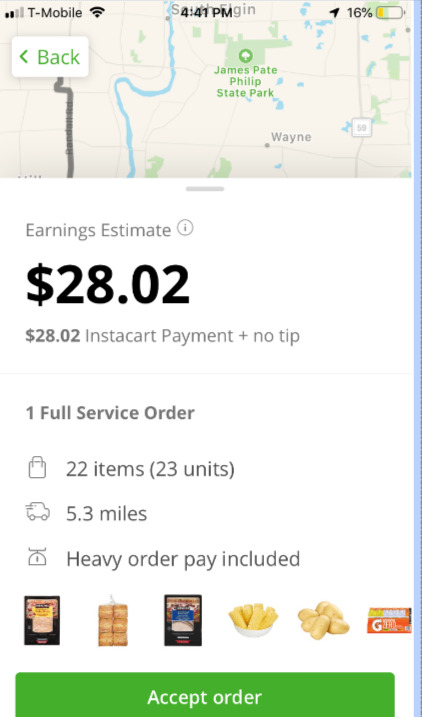

. Bestreferral Team April 16 2022 Reading Time. Download the Instacart app or start shopping online now with Instacart to get. So if youre a full-service Instacart worker you are responsible for reporting any income you make through Instacart and paying taxes on that.

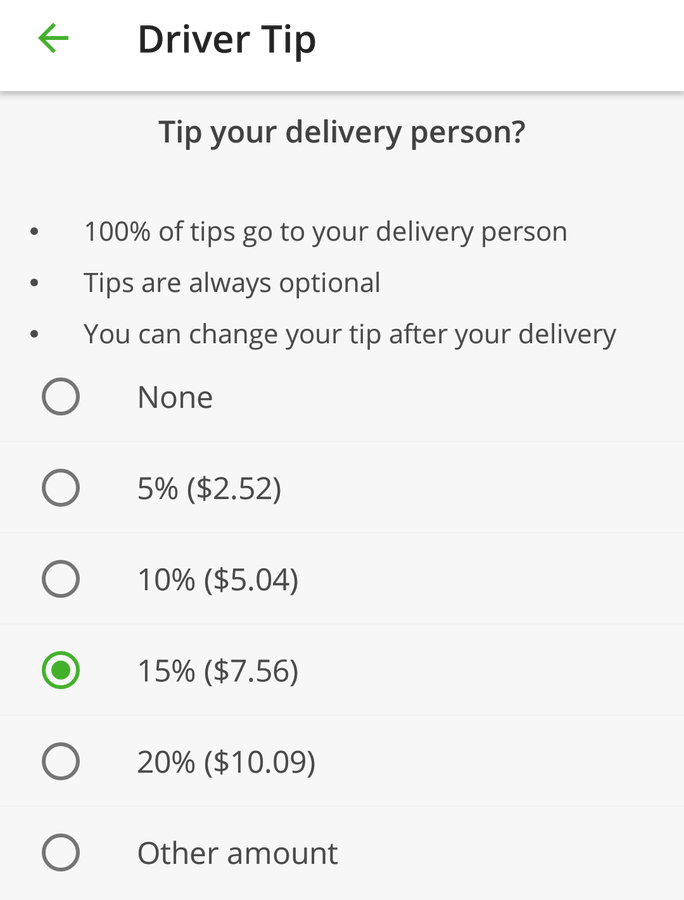

Instacart only takes out taxes for W-2 employees. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

This can make for a frightful astonishment when duty time moves around. Thanks for your reply. Attend an in-person orientation.

Whether you choose to work for. Fill out the paperwork. This step levels the playing field allowing you to deduct the employers half.

Instacart delivery starts at 399 for same-day orders over 35. For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Answered April 26 2018.

Get answers to your biggest company questions on Indeed. In-store shoppers are classified as Instacart employees and are treated like other employees working the usual 9-5. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Has to pay taxes. I called IRS tax assistance but the lady said delivery driver doesnt fall into self-employed category and after a questionnaire she told me that I dont need to file a tax. Most people know to file and pay their taxes by April 15th.

3015 reviews from Instacart Shoppers employees. January 16 2023 Pay estimated taxes for Sept 1 to Dec 31 Find out if you owe quarterly taxes here. If youre an Instacart shopper you are self-employed that means you likely owe quarterly taxes.

No taxes are taken out of your Doordash paycheck. Does Instacart take taxes out of. Everybody who makes income in the US.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Find answers to Do they take out taxes from Instacart employees. Does Instacart Take Out Taxes.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. As youre liable for paying the essential state and government income taxes on the cash you make. There will be a clear indication.

However Shipt will supply you with a 1099 form in January or February. W-2 employees also have to pay FICA taxes to the tune of 765. The employer gets to claim that 765 of wages as a business expense.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Instacart withholds taxes for them automatically and sends. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

But if you choose to work as an Instacart full-service shopper. Does Instacart take out taxes. The exception is if you accepted.

If taxes drive you crazy youre not alone. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. You have to take out your own independent contractor taxes.

Ultimate Tax Filing Guide. This is part of the onboarding process.

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

What You Need To Know About Instacart Taxes Net Pay Advance

How To Handle Your Instacart 1099 Taxes Like A Pro

First Time Ordering Instacart As A Customer Usually A Shopper Why In The Hell Is There Such A Massive Service Fee And Why Is It More Than The Payout Of Some Batches

What You Need To Know About Instacart 1099 Taxes

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

How To File Your Taxes As An Instacart Shopper Contact Free Taxes

How Much Does Instacart Pay Shoppers Per Hour Quora

Instacart Shopper Review Is Instacart Worth It In 2022

What You Need To Know About Instacart Taxes Net Pay Advance

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Partnering With Stride To Bring Shoppers Affordable Insurance

What You Need To Know About Instacart 1099 Taxes